Daily planner ideas are essential for anyone who wants to stay organized and productive. A daily planner is a useful tool that can help you keep track of your schedule, appointments, and to-do lists. With the right daily planner ideas, you can customize your planner to suit your needs and preferences. One of the most important daily planner ideas is to create a daily task list. This list should include all the tasks that you need to complete for the day, and you can prioritize them based on their importance.

Another useful daily planner idea is to include a gratitude list. This list can help you focus on the positive aspects of your life and can help you feel more grateful for what you have. You can also include a section for notes and ideas, where you can jot down any thoughts or ideas that come to mind throughout the day. With these daily planner ideas, you can create a planner that is tailored to your needs and that can help you stay organized and productive.

Understanding Daily Planners

Daily planners are tools designed to help individuals manage their time better, prioritize tasks, and reduce mental clutter by keeping important information all in one place. They are popular among people who want to stay organized and productive.

The Purpose of a Daily Planner

The purpose of a daily planner is to help individuals manage their daily tasks, appointments, and goals. It enables them to plan their day, week, or month in advance, ensuring that they accomplish their goals and meet deadlines. Daily planners also help individuals track their progress and keep them motivated towards achieving their goals.

Types of Daily Planners

There are different types of daily planners available in the market, each with its own design, style, and customization options. Some daily planners come with pre-designed templates that users can personalize and customize to their liking. Others offer a blank slate for users to create their own layouts.

Daily planners can be physical or digital. Physical daily planners come in various sizes and designs, from pocket-sized planners to large desk planners. They are great for people who prefer a tactile experience and enjoy writing things down by hand.

Digital daily planners, on the other hand, are available as apps or software that users can access on their smartphones, tablets, or computers. They are great for people who prefer a more streamlined and tech-savvy experience.

Daily planners are essential tools for individuals who want to stay organized and productive. They come in different types, designs, and customization options, allowing users to personalize their planner to their liking.

Setting Up Your Daily Planner

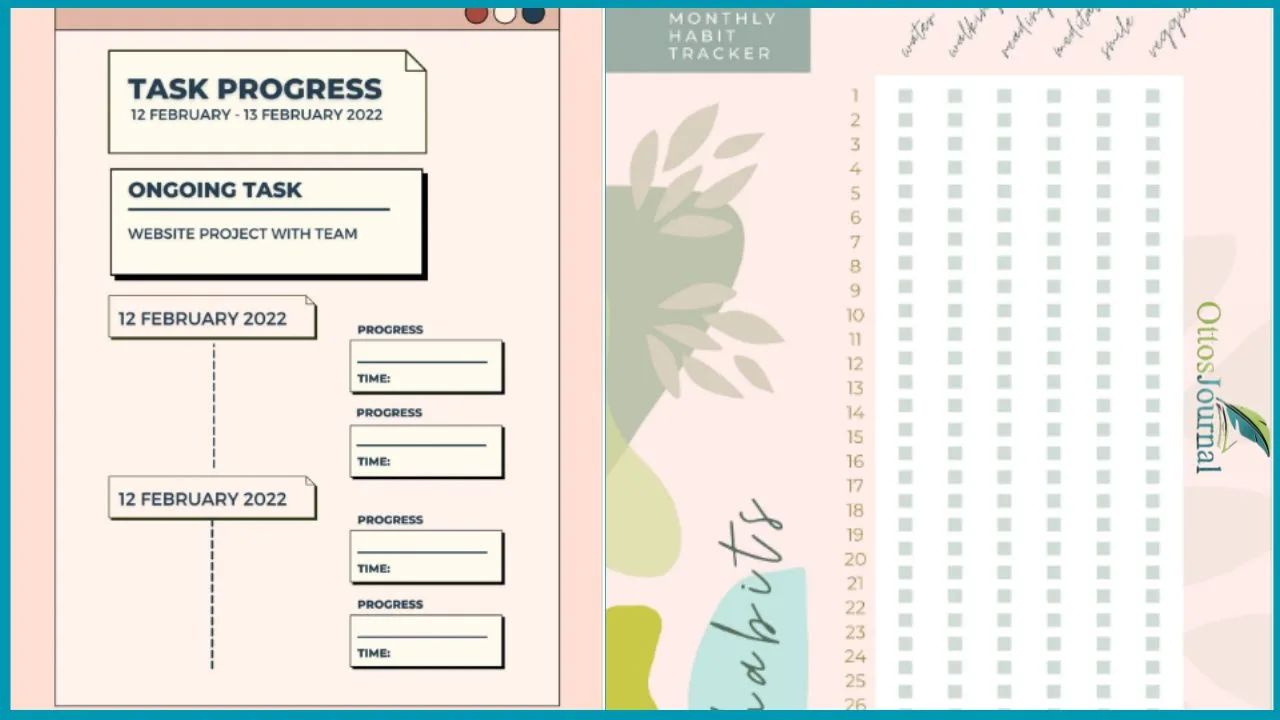

When setting up a planner, it is crucial to choose the right template that aligns with your personal goals and priorities. There are various templates available, including bullet journals, monthly calendars, trackers, and to-do lists. Consider your planning needs and choose the right template that suits your preferences.

Choosing the Right Template

If you are someone who likes to prioritize tasks, a to-do list might be a good option for you. On the other hand, if you have a lot of appointments and events to keep track of, a monthly calendar might be more suitable. If you want to track your progress towards specific goals, a tracker or bullet journal could be a good choice.

Once you have chosen the right template, you can start customizing it to fit your specific needs. Personalization is key when it comes to setting up a planner.

Customization Techniques

Customization can involve adding personal touches such as stickers, photos, and colors to make the planner more visually appealing. It can also involve adding specific sections such as a task list, checklist, or goal tracker. Some planners offer the option to print or download templates, which can be useful for those who prefer a physical copy or want to have a digital backup.

The key to setting up a planner is to make it work for you. Take the time to plan out your goals, tasks, and appointments and choose a template that aligns with your needs. With the right layout and customization, a planner can be a powerful tool for staying organized and productive.

Incorporating Creativity and Personalization

One of the best ways to make a daily planner more enjoyable and effective is by incorporating creativity and personalization. This can be done through a variety of decorative elements and personal touches that will make the planner feel unique and special to the individual using it.

Decorative Elements

Decorative elements such as stickers, washi tape, illustrations, and doodles can add a fun and colorful touch to a daily planner. They can be used to highlight important dates or events, add emphasis to specific tasks, or simply make the planner more visually appealing. Color schemes and fonts can also be used to create a cohesive and aesthetically pleasing look.

Personal Touches

Personal touches such as quotes, handwriting, and icons can add a sense of personality and individuality to a daily planner. Quotes can be used to provide motivation or inspiration, while handwriting can make the planner feel more personal and intimate. Icons can be used to represent specific tasks or events, and can be customized to fit the individual’s preferences and needs.

Incorporating creativity and personalization into a daily planner can make it more enjoyable to use and more effective in helping the individual achieve their goals. By using a combination of decorative elements and personal touches, individuals can create a planner that is uniquely their own and tailored to their specific needs and preferences.

55 Daily Planner Ideas And For A Productive Day

- Prioritized Task List: Start with three must-do tasks for the day.

- Hourly Schedule: Outline each hour with specific activities or appointments.

- Top Goals: Write down the top goal you want to achieve today.

- Affirmations: Begin with positive affirmations for self-motivation.

- Morning Routine: List your morning activities to start the day right.

- Evening Routine: Plan your wind-down activities for the night.

- Daily Gratitude: Write one thing you are grateful for today.

- Water Intake: Set targets for water consumption and track intake.

- Meal Planning: Note down your meals for breakfast, lunch, and dinner.

- Exercise Plan: Schedule your workout and set exercise goals.

- Focus Time: Block a period for deep work without distractions.

- Break Times: Schedule short breaks to stay refreshed.

- Daily Reflection: End the day with thoughts on what went well.

- Mood Tracker: Keep a simple chart to note your mood throughout the day.

- Daily Wins: Record small victories or progress made.

- Inspiration Source: Write down a quote or idea that inspires you today.

- Reading Time: Allocate a slot for reading and list the material.

- Self-Care Activity: Plan at least one act of self-care.

- Learning Goal: Set aside time to learn something new.

- Budget Check-In: Review your spending for the day.

- Social Connection: Plan to reach out to a friend or family member.

- Creative Hour: Dedicate time to a creative hobby or project.

- Daily Challenge: Set a small challenge to complete.

- Mindfulness Practice: Schedule a meditation or breathing exercise.

- Skill Practice: Carve out time to practice a skill you’re developing.

- Networking Goal: Identify someone to connect with professionally.

- Journaling Prompt: Start with a prompt for reflective writing.

- Random Act of Kindness: Plan to do something nice for someone else.

- Daily De-clutter: Choose an area or item to organize or clean.

- Email Management: Set specific times to check and respond to emails.

- Daily Review: Outline what you need to review or recap today.

- Nature Time: Schedule a walk or time outside.

- Daily Intention: Set an intention for how you want to approach the day.

- Health Check: Listen to your body and note any health observations.

- Daily Learning: Identify something new you want to understand today.

- Task Delegation: Decide on tasks to delegate and to whom.

- Hygiene Routine: List your personal care tasks.

- Daily Visualization: Spend time visualizing your goals or desires.

- Errands List: Note down errands and plan the most efficient route.

- Phone Calls: List calls you need to make with notes on the purpose.

- Daily Habit Tracker: Pick a habit you’re building and check it off.

- Personal Finance Check: Quick review of your financial status.

- Meal Prep Planning: Plan and list steps for preparing upcoming meals.

- News Update: Allocate time to catch up on current events.

- Daily Unplug: Schedule tech-free time to disconnect.

- Daily Cleanup: Set a timer for a quick tidy-up session.

- Appointment Prep: Prepare for any meetings or appointments.

- Daily Puzzle: Solve a crossword, Sudoku, or other brain game.

- Pet Care: Schedule feeding, walks, or playtime with your pet.

- Checklist: Create a checklist for repetitive daily tasks.

- Daily Research: Allocate time for research on any topic of interest.

- Language Practice: Dedicate time to practice a new language.

- Daily Outreach: Plan to send a message or email to expand your network.

- Goal Review: Briefly review your progress on long-term goals.

- Evening Questions: End the day with questions about what you learned or enjoyed.

Enhancing Productivity and Organization

Effective Task Management

One of the most important aspects of daily planning is effective task management. To achieve this, individuals should start by creating a schedule that outlines their daily activities. This schedule should prioritize tasks based on their level of importance and due dates. By prioritizing tasks, individuals can ensure that they are completing the most important tasks first and avoiding unnecessary stress.

A habit tracker can also be a useful tool for effective task management. By tracking habits, individuals can identify areas where they need to improve and make adjustments to their daily routine. This can help them develop better habits and increase their productivity.

Time Management Strategies

Time management is another critical aspect of daily planning. Individuals should start by identifying their priorities and allocating time for each task accordingly. They should also consider using a project schedule to help them manage their time more effectively. A daily schedule template can be a useful tool for this purpose.

To manage their time effectively, individuals should also consider using time management strategies such as the Pomodoro technique. This technique involves breaking down work into 25-minute intervals, with short breaks in between. This can help individuals stay focused and avoid burnout.

Effective task management and time management strategies are essential for enhancing productivity and organization. By prioritizing tasks, tracking habits, and managing time effectively, individuals can achieve their goals and increase their overall productivity.

Lifestyle Integration with Your Daily Planner

Keeping track of daily activities and goals is essential for a balanced lifestyle. A daily planner is an effective tool for managing tasks, appointments, and personal goals. Integrating lifestyle activities into a daily planner can help individuals maintain a healthy and productive lifestyle.

Health and Wellness Tracking

A daily planner can be used to track health and wellness goals. Tracking exercise routines, water intake, and meals can help individuals stay on track with their health goals. Mood trackers can be used to monitor mental health and self-care activities. Affirmations can also be incorporated into a daily planner to promote positivity and motivation.

Balancing Work and Personal Life

A daily planner can help individuals balance work and personal life. By scheduling work tasks and personal activities, individuals can ensure that they are not overworking or neglecting personal commitments.

Brain dump and reflection sections can also be added to a daily planner to help individuals organize their thoughts and prioritize tasks. Budgeting and grocery lists can also be included to help individuals manage their finances and save time.

Integrating lifestyle activities into a daily planner can help individuals maintain a balanced and productive lifestyle. By tracking health and wellness goals and balancing work and personal life, individuals can prioritize their tasks and achieve their goals efficiently.

Frequently Asked Questions

What are the essential elements to include in a daily planner for maximum productivity?

A daily planner should include a to-do list, a schedule, and a notes section. The to-do list will help to keep track of tasks that need to be done, while the schedule will allow you to plan out your day and allocate time for each task. The notes section can be used to jot down important information or ideas that come up throughout the day. It is also important to prioritize tasks and schedule them based on their importance and urgency.

How can one effectively organize their daily planner for academic success?

For academic success, a daily planner should include a section for assignments, deadlines, and exams. It is important to schedule study time and allocate enough time for each task. Breaking down larger projects into smaller tasks can also help to make them more manageable. Color coding can also be used to differentiate between different subjects or tasks.

What are some creative ways to enhance the visual appeal of a daily planner?

Using stickers, washi tape, and colorful pens can help to make a daily planner more visually appealing. Adding inspirational quotes or images can also help to motivate and inspire. It is also important to choose a planner with a layout that suits your needs and preferences.

Can you provide examples of how to layout a daily planner for workplace efficiency?

For workplace efficiency, a daily planner should include a section for meetings, deadlines, and tasks. It is important to prioritize tasks and schedule them based on their importance and urgency. Color coding can also be used to differentiate between different projects or tasks. It is also important to schedule breaks and allocate time for self-care.

What strategies can beginners use to start planning effectively with a daily planner?

Beginners can start by setting goals and breaking them down into smaller tasks. It is important to prioritize tasks and schedule them based on their importance and urgency. Using color coding and stickers can also help to make a daily planner more visually appealing and easier to navigate.

Where can one find downloadable daily planner templates that they can customize?

There are many websites that offer free downloadable daily planner templates, such as Canva, Trello, and Evernote. It is important to choose a template that suits your needs and preferences. Templates can be customized by adding or removing sections, changing the layout, and adding personal touches such as stickers or images.