Bullet journaling has become a popular method for keeping track of various aspects of one’s life. It allows people to organize their thoughts, tasks, and goals in a creative and personalized way. One area where bullet journaling can be especially useful is budgeting. In this blog post, I will share with you simple bullet journal budget ideas to help you manage your finances

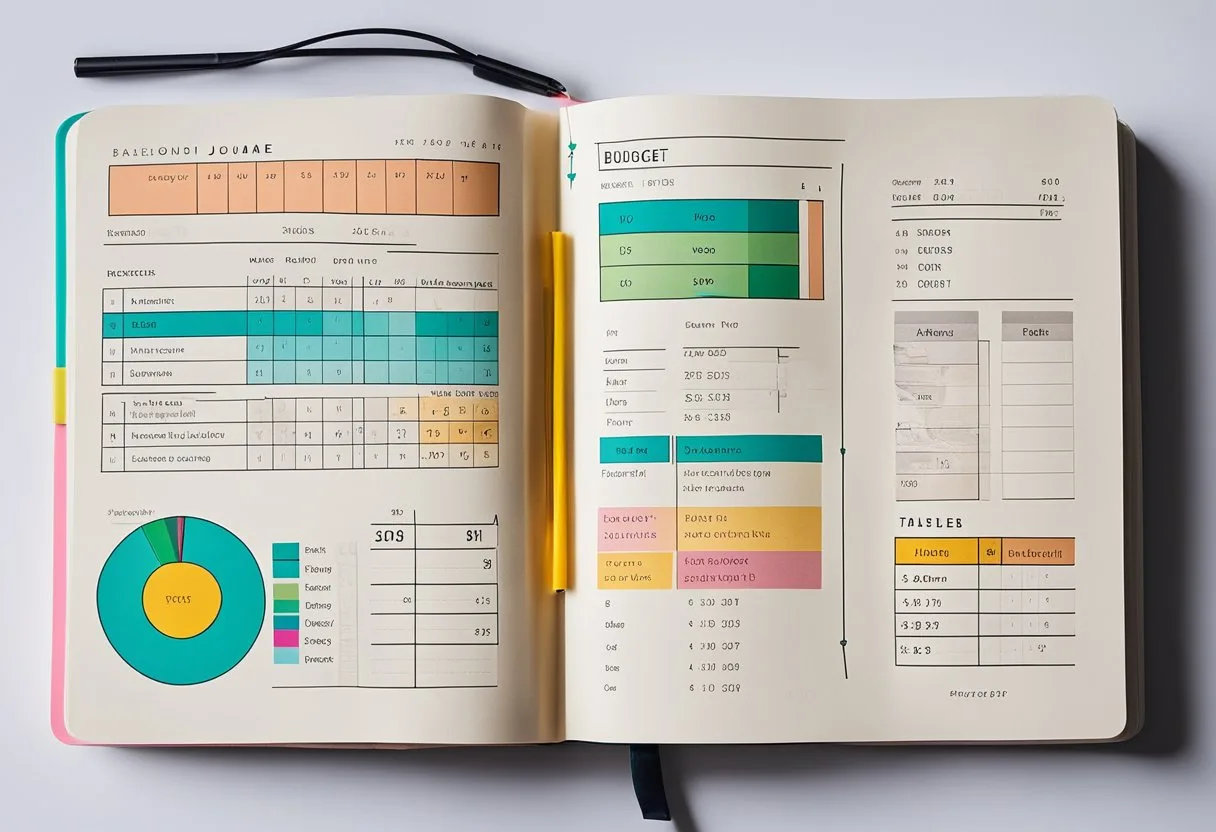

There are many different bullet journal budget ideas that can be implemented, depending on personal preferences and financial situations. Some people may prefer to have a monthly budget tracker, while others may find it helpful to have a weekly or daily expense log. Visual aids such as graphs and charts can also be incorporated to make it easier to understand spending patterns and identify areas where adjustments can be made. Bullet journals can be used to set financial goals and track progress towards achieving them, whether it’s saving for a vacation or paying off debt.

Setting Up Your Bullet Journal for Budgeting

Bullet journaling is a creative and customizable way to keep track of your finances. It allows you to have a minimalist budget tracker that is tailored to your needs. In this section, we will discuss how to set up your bullet journal for budgeting.

Choosing the Right Layout

One of the best things about bullet journals is that they are highly customizable. You can choose from a wide range of layouts that suit your style and preferences. When it comes to budgeting, there are several layouts that you can use. Some popular ones include:

- Monthly budget tracker

- Spending tracker

- Monthly bills tracker

- Financial goals spread

- Credit card debt reduction tracker

- Debt tracker

Choose a layout that works best for you. You can also create your own layout if you have a specific idea in mind. The key is to keep it simple and easy to use.

Essential Bullet Journal Budget Spreads

There are several essential bullet journal budget spreads that you should consider including in your journal. These spreads will help you keep track of your finances and stay on top of your budget. Some of these spreads include:

- Monthly budget tracker: This spread helps you keep track of your income and expenses for the month. You can set a budget for each category, such as groceries, entertainment, and transportation, and track your spending.

- Spending tracker: This spread allows you to track your daily expenses. You can record everything you spend money on, including small purchases like coffee and snacks.

- Financial goals spread: This spread helps you set and track your financial goals. You can set goals for saving, paying off debt, and investing.

- Debt tracker: This spread allows you to track your debt and monitor your progress as you pay it off.

Setting up your bullet journal for budgeting is a great way to stay on top of your finances. Choose a layout that works for you, and include essential budget spreads to help you keep track of your income and expenses. With a little creativity and dedication, you can create a minimalist budget tracker that helps you achieve your financial goals.

Tracking Finances with Your Bullet Journal

Keeping track of finances is essential for achieving financial goals. A bullet journal is an effective way to track spending, bills, debt, and savings goals. With a bullet journal, one can create customized financial spreads that cater to their specific needs.

Monthly Budget Tracker

A monthly budget tracker is a crucial financial spread in a bullet journal. It helps one manage their spending habits by tracking monthly expenses and income. One can create a table with columns for expenses, income, and savings. This tracker helps one stay within their budget and identify areas where they overspend.

Expense Tracker

An expense tracker is another essential financial spread in a bullet journal. It helps one track daily expenses and identify areas where they can cut back on spending. One can create a table with columns for date, item, cost, and category. This tracker helps one become more aware of their spending habits and make necessary adjustments.

Savings Tracker

A savings tracker is a financial spread that helps one track their progress towards their savings goals. One can create a table with columns for savings goal, amount saved, and remaining balance. This tracker helps one stay motivated and focused on achieving their financial goals.

Bill and Debt Tracker

A bill and debt tracker is a financial spread that helps one keep track of their bills and debt payments. One can create a table with columns for bill/debt name, due date, amount due, and payment status. This tracker helps one avoid missed payments and stay on top of their debt.

Abullet journal is an effective tool for tracking finances. By creating customized financial spreads, one can manage their spending, bills, debt, and savings goals. With a bullet journal, one can become more aware of their financial habits and make necessary adjustments to achieve their financial goals.

Analyzing and Adjusting Your Spending Habits

To take control of one’s finances, it is essential to analyze and adjust spending habits. This can be done by reviewing monthly expenses and identifying areas for saving money.

Reviewing Monthly Expenses

To analyze spending habits, one can start by keeping a detailed spending log for a month. This log should include all expenses, no matter how small, and should be organized into categories such as food, transportation, entertainment, and so on.

Once the month is over, the spending log can be reviewed to identify areas where money is being spent unnecessarily. This process can be made easier by using a spending tracker, which can help to categorize expenses and provide a clear picture of where money is going each month.

Identifying Areas for Saving Money

After reviewing monthly expenses, the next step is to identify areas where money can be saved. This can be done by looking for patterns in spending habits and finding ways to cut costs.

For example, if a person is spending a lot of money on eating out, they can try cooking more meals at home or bringing lunch to work. If they are spending too much on transportation, they can look for ways to carpool or use public transportation instead of driving alone.

By making a detailed and planned budget spread, individuals can identify areas where they can cut back on expenses and save money. This can be done by setting realistic financial goals and finding ways to achieve them.

Analyzing and adjusting spending habits is an important step in taking control of one’s finances. By reviewing monthly expenses and identifying areas for saving money, individuals can make a detailed and effective budget spread that will help them achieve their financial goals.

Advanced Budgeting Techniques and Tips

When it comes to budgeting, there are a few advanced techniques and tips that can help make the process more effective and efficient. By incorporating these techniques, individuals can better plan and manage their finances, set and achieve financial goals, and prepare for emergencies and large purchases.

Creating a Financial Calendar

One advanced technique is to create a financial calendar. This can help individuals keep track of important financial deadlines, such as bill due dates, loan payments, and tax deadlines. By having a clear understanding of when these events occur, individuals can better plan and budget for them, ensuring that they have enough money set aside to cover the costs.

Setting and Tracking Financial Goals

Another important technique is to set and track financial goals. This can help individuals stay motivated and focused on their financial objectives, whether that’s saving for a dream vacation or paying off debt. By setting specific, measurable goals and tracking progress towards them, individuals can better understand their financial situation and make adjustments as needed.

Planning for Emergencies and Large Purchases

Finally, it’s important to plan for emergencies and large purchases. This means setting aside money in an emergency fund, which can help cover unexpected expenses such as medical bills or car repairs. Individuals should plan ahead for large purchases, such as a new car or home, by saving up and researching financing options.

By incorporating these advanced budgeting techniques and tips, individuals can better plan and manage their finances, set and achieve financial goals, and prepare for emergencies and large purchases. Whether it’s creating a financial calendar, setting and tracking financial goals, or planning for emergencies and large purchases, these techniques can help individuals take control of their finances and achieve financial success.

Frequently Asked Questions

What essential elements should I include in a budget journal for effective finance management?

To create a budget journal for effective finance management, it’s important to include essential elements such as a monthly budget tracker, expense tracker, and savings tracker. These elements will help you to keep a record of your income, expenses, and savings, and enable you to make informed decisions about your finances.

How can I effectively track my daily expenses using a bullet journal?

To effectively track your daily expenses using a bullet journal, you can create a daily expense log where you record all your expenses for the day. You can also create a weekly or monthly summary of your expenses to get a better overview of your spending patterns.

What are some creative ideas for setting up a bullet journal savings tracker?

Some creative ideas for setting up a bullet journal savings tracker include creating a visual representation of your savings goal, using a savings jar tracker, or creating a savings challenge where you save a certain amount of money each week or month.

How can I create a bullet journal budget tracker that’s easy to use and print at home?

To create a bullet journal budget tracker that’s easy to use and print at home, you can use a simple layout with columns for income, expenses, and savings. You can also use color-coding or symbols to categorize your expenses and make it easier to read and understand.

Can you suggest a monthly budget layout for my bullet journal that maximizes financial oversight?

A monthly budget layout for a bullet journal that maximizes financial oversight can include a monthly budget tracker, expense tracker, and savings tracker. You can also include a summary of your income and expenses for the month, and use color-coding or symbols to categorize your expenses.

What are the best practices for maintaining a spending journal to manage personal finances?

The best practices for maintaining a spending journal include recording all your expenses, categorizing your expenses, setting a budget, and regularly reviewing your spending patterns. It’s also important to be honest with yourself about your spending habits and make adjustments as needed to achieve your financial goals.