Bullet journaling is a popular method of organizing and tracking various aspects of one’s life, from daily tasks to long-term goals. One area where bullet journaling can be particularly helpful is in managing personal finances. A financial tracker bullet journal can help individuals keep track of their income, expenses, savings, and debt in a clear and organized way.

With a financial tracker bullet journal, individuals can create customized pages to suit their specific needs and goals. For example, they might create a monthly budget page to track their income and expenses, a savings tracker page to monitor progress towards a savings goal, and a debt repayment page to keep track of payments and progress towards paying off debt. By using a bullet journal to track their finances, individuals can gain a better understanding of their financial situation and make more informed decisions about their money.

There are many resources available online for those interested in creating a financial tracker bullet journal. From templates and printables to tutorials and inspiration, individuals can find a wealth of information to help them get started. With a bit of creativity and effort, a financial tracker bullet journal can be a powerful tool for taking control of one’s finances and achieving financial goals.

Setting Up Your Financial Tracker

When it comes to setting up your financial tracker, there are a few things to consider. Firstly, choosing the right bullet journal is essential. Secondly, you’ll need to gather essential bullet journal supplies.

Choosing the Right Bullet Journal

The bullet journal system is based on the idea of pen and paper, so it’s important to choose a journal that you enjoy writing in. A customizable journal is ideal for creating a financial tracker as it will allow you to create the layout that works best for you.

Essential Bullet Journal Supplies

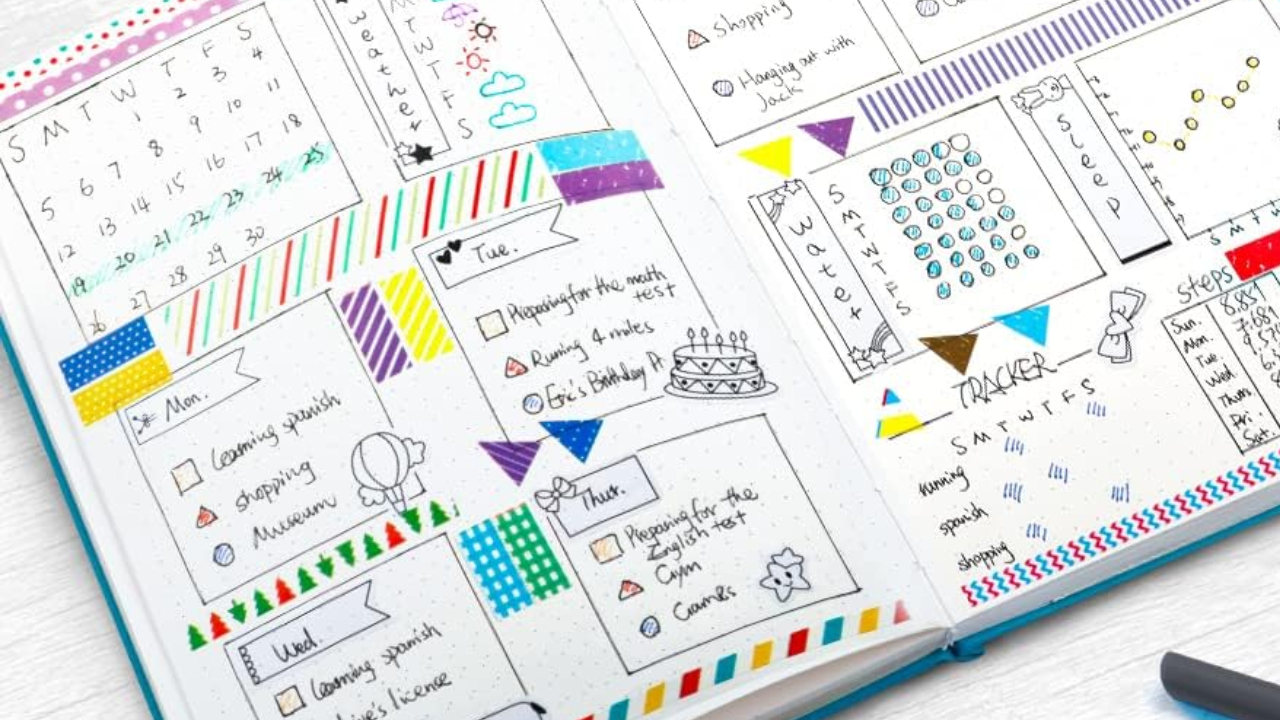

In addition to your journal, there are a few essential supplies you’ll need to get started. These include pens, markers, and washi tape. You can use different colors to categorize your expenses and income, making it easier to read and understand your financial tracker.

When it comes to setting up your financial tracker, it’s important to find a system that works best for you. Bullet journalling is a great way to keep track of your finances and can be customized to fit your needs. With the right journal and supplies, you can create a financial tracker that is both functional and enjoyable to use.

Creating Your Budgeting System

Managing finances can be overwhelming, but using a bullet journal budget tracker can make it much easier. Here are some tips to create a budgeting system that works for you.

Designing a Monthly Budget Tracker

Designing a monthly budget tracker is essential to keeping track of your expenses and income. Start by creating a table with columns for income and expenses. In the income column, list all sources of income, such as salary, freelance work, or rental income. In the expenses column, list all recurring expenses, such as rent, utilities, groceries, dining out, transportation, and entertainment.

Use colors or symbols to categorize your expenses, such as red for bills, green for groceries, and blue for entertainment. This will make it easier to see where your money is going and identify areas where you can cut back.

Categorizing Expenses and Income

Categorizing your expenses and income is crucial to understanding your spending habits. Divide your expenses into categories such as housing, transportation, food, and entertainment. This will help you identify areas where you can reduce your spending.

When categorizing your income, make sure to include all sources, including freelance work, rental income, and side hustles. This will give you a more accurate picture of your overall financial situation.

Managing Bills with a Bill Tracker

Managing bills can be stressful, but using a bill tracker can help you stay on top of your payments. Create a table with columns for the bill name, due date, amount, and payment status. Record each bill in a new row and update the payment status as you pay each bill.

Include all recurring bills, such as rent, utilities, subscriptions, and credit card payments. This will help you avoid late fees and keep your credit score in good standing.

Using a bullet journal budget tracker can help you gain control of your finances and achieve your financial goals. By designing a monthly budget tracker, categorizing your expenses and income, and managing bills with a bill tracker, you can create a budgeting system that works for you.

![]()

Monitoring Savings and Debts

When it comes to personal finance, monitoring savings and debts is essential. A bullet journal can be a great tool for keeping track of financial goals, debt repayment, and savings progress. Here are some ways to use a bullet journal to monitor savings and debts.

Setting Financial Goals

The first step to monitoring savings and debts is setting financial goals. By setting clear and specific goals, it becomes easier to track progress and stay motivated. Goals can include building an emergency fund, saving for a down payment, or paying off credit card debt.

One effective way to track financial goals in a bullet journal is by creating a savings tracker. This can be a simple table or graph that shows progress towards the goal. By regularly updating the tracker, it becomes easier to stay on track and adjust plans as needed.

Tracking Debt Repayment

Debt can be a major obstacle to achieving financial goals. That’s why tracking debt repayment is crucial. One popular method for debt repayment is the “debt snowball” method, popularized by personal finance expert Dave Ramsey. This method involves paying off debts in order from smallest to largest, regardless of interest rate.

To track debt repayment in a bullet journal, consider creating a debt tracker. This can be a table or graph that shows progress towards paying off each debt. By regularly updating the tracker, it becomes easier to stay motivated and see the progress being made.

Visualizing Savings Progress

Visualizing savings progress can be a powerful motivator. One way to do this in a bullet journal is by creating a savings jar tracker. This involves drawing a jar or piggy bank and coloring it in as savings accumulate. Another option is to create a graph that shows savings progress over time.

By regularly updating the savings tracker, it becomes easier to see the progress being made towards financial goals. This can be a powerful motivator to keep saving and stay on track.

A bullet journal can be a valuable tool for monitoring savings and debts. By setting clear financial goals, tracking debt repayment, and visualizing savings progress, it becomes easier to achieve financial stability and reach long-term financial goals.

Analyzing Spending Patterns

Creating a Spending Log

One of the most important steps in managing finances is tracking expenses. A spending log is a great way to keep track of all expenses and income. A bullet journal finance tracker can help create a spending log by recording every expense and income. This can be done by making a table or a list of all the expenses and income. It is essential to record every expense and income to get an accurate picture of the financial situation.

Identifying and Changing Habits

Once a spending log is created, it is easier to identify spending habits. A bullet journal finance tracker can help track spending habits by using visual representations such as bar graphs and pie charts.

Symbols can also be used to track expenses and income. By analyzing the spending patterns, it is possible to identify areas where money is being spent unnecessarily. For example, if someone is spending a lot of money on eating out, they can reduce the number of times they eat out in a week.

Changing spending habits can be challenging, but it is essential to manage finances better. No-spend days or weeks can be incorporated into the spending log to help reduce expenses. A no-spend day is a day where no money is spent on anything except essential expenses. This can help break the habit of spending money unnecessarily.

Abullet journal finance tracker is an effective tool for managing finances. By creating a spending log and tracking expenses, it is possible to identify spending habits and areas where money is being spent unnecessarily. Changing spending habits can be challenging, but incorporating no-spend days or weeks can help reduce expenses. By analyzing spending patterns, it is possible to manage finances better.

Frequently Asked Questions

How can I effectively track my spending in a bullet journal?

To effectively track spending in a bullet journal, it is important to create a clear and detailed system that works for you. One way to do this is to create a separate page for each expense category, such as groceries, entertainment, and bills.

You can also use symbols or color-coding to differentiate between different types of expenses. It’s important to review your spending regularly to identify areas where you can cut back and save money.

What creative ideas can I incorporate into my budget notebook?

There are many creative ideas you can incorporate into your budget notebook, such as adding inspirational quotes or pictures to keep you motivated. You can also create a vision board that includes your financial goals and aspirations. Another idea is to create a debt payoff tracker that shows your progress towards paying off your debts.

Which bullet journal layout works best for monthly budgeting?

The best bullet journal layout for monthly budgeting depends on your personal preferences and needs. Some popular layouts include the traditional monthly spread, where you list your income and expenses for the month, and the habit tracker, which allows you to track your spending habits over time. You can also create a budget envelope system, where you use envelopes to separate your money into different categories.

Where can I find printable templates for a bullet journal budget tracker?

There are many websites and blogs that offer free printable templates for bullet journal budget trackers. Pinterest is a great resource for finding templates, as well as blogs and websites dedicated to bullet journaling. You can also create your own template using a spreadsheet program like Excel or Google Sheets.

How do I set up a savings tracker in my financial bullet journal?

To set up a savings tracker in your financial bullet journal, create a separate page dedicated to tracking your savings goals. You can use a graph or chart to show your progress towards your goal, or create a simple list of your savings goals and how much you need to save to reach them. It’s important to review your savings tracker regularly and adjust your savings plan as needed to stay on track.

What are some efficient ways to log expenses in a bullet journal?

There are many efficient ways to log expenses in a bullet journal, such as using a simple list format, creating a table or chart to track expenses over time, or using symbols or color-coding to differentiate between different types of expenses. It’s important to find a system that works for you and to review your expenses regularly to stay on track with your budget.