Bullet journaling is a popular method for organizing and tracking various aspects of one’s life. One area where bullet journaling can be particularly helpful is in budgeting. By creating a budget bullet journal spread, individuals can easily keep track of their income, expenses, and financial goals.

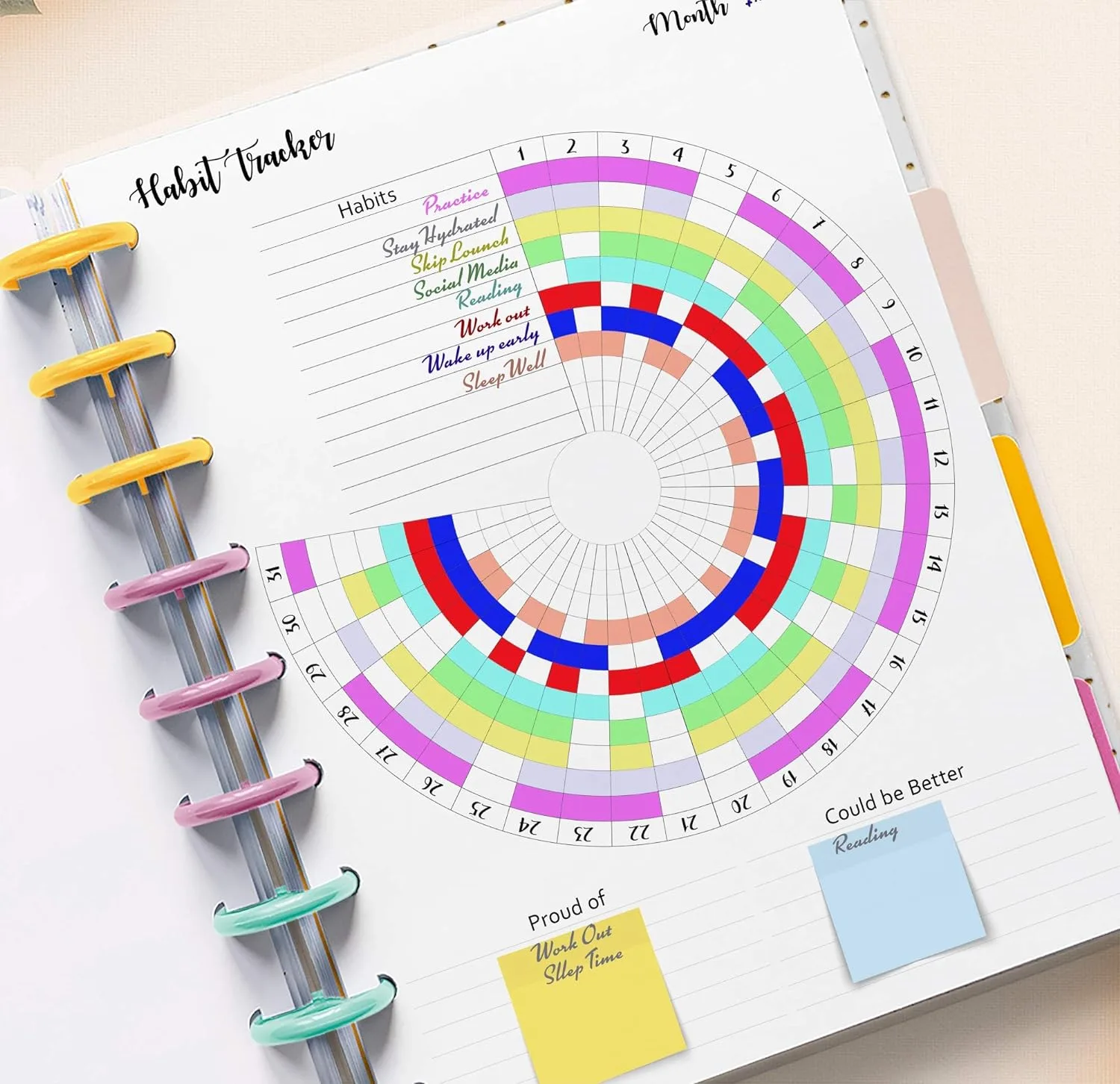

A budget bullet journal spread can take many forms, depending on the individual’s preferences and needs. Some common elements of a budget spread include a monthly budget tracker, a savings tracker, and a debt repayment plan. These spreads can be customized with different colors, symbols, and designs to make them both functional and visually appealing.

A budget bullet journal spread can be a useful tool for anyone looking to take control of their finances. By tracking income and expenses, setting financial goals, and monitoring progress, individuals can make informed decisions about their spending and saving habits. Whether you’re saving up for a big purchase or trying to pay off debt, a budget bullet journal spread can help you stay on track and achieve your financial goals.

Setting Up Your Budget Bullet Journal

Choosing Your Journal

Before starting a budget bullet journal, it is important to choose the right journal. A dotted or guided journal is recommended as it gives more flexibility to create unique spreads. The journal should have enough pages to last for at least a year.

Bullet Journal Layouts

A bullet journal layout is a visual representation of your budget that helps to keep track of your expenses and income. It is important to choose a minimalist budget tracker that is easy to use and understand. There are many bullet journal templates available online that can be used as a reference.

Monthly Budget Tracker

A monthly budget tracker is a crucial part of a budget bullet journal. It helps to keep track of your expenses and income for the month. It is recommended to create a table of contents for the monthly budget tracker to make it easier to find and use.

Expense Trackers

Expense trackers are used to track expenses that are not part of the monthly budget. These expenses may include unexpected bills or expenses that are not part of the regular monthly expenses. It is important to create a separate section for expense trackers to keep track of these expenses.

Abudget bullet journal is an effective way to keep track of your finances. Choosing the right journal, creating a minimalist budget tracker, and using a monthly budget tracker and expense trackers are important steps in setting up a budget bullet journal. By following these steps, one can easily manage their finances and achieve their financial goals.

Managing Finances with Bullet Journaling

Bullet journaling is a simple and creative way to manage finances. With a bullet journal, individuals can easily track their income and expenses, savings, debt, and bills. This section will cover some of the ways bullet journaling can help manage finances.

Income and Expense Logging

One of the most basic ways to manage finances with bullet journaling is by logging income and expenses. This can be done on a monthly or weekly basis, depending on the individual’s preference. By keeping a spending log, individuals can track their spending habits and identify areas where they can cut back. This can help them stay within their budget and achieve their financial goals.

Savings Tracker

Saving money is an important part of financial planning. With a bullet journal, individuals can easily track their savings goals and progress. They can create a savings tracker page to monitor their progress towards their savings goals. This can help them stay motivated and on track to achieving their financial goals.

Debt Tracker

Managing debt can be challenging, but with a bullet journal, individuals can easily track their debt payments and progress. They can create a debt tracker page to monitor their debt payments and progress. This can help them stay motivated and on track to paying off their debt.

Bill Tracker

Keeping track of bills is important to avoid missed payments and late fees. With a bullet journal, individuals can create a bill tracker page to monitor their bills and due dates. This can help them stay organized and avoid missed payments.

Bullet journaling is a simple and effective way to manage finances. By using different tracker pages, individuals can easily monitor their financial situation and achieve their financial goals.

Customizing Your Budget Spread

When it comes to creating a budget bullet journal spread, customization is key. Everyone’s financial situation is different, and your budget spread should reflect that. Here are some ideas for customizing your budget spread to fit your needs.

Visuals and Lettering

Visuals and lettering can help make your budget spread more appealing and easier to read. Consider using different fonts and colors to separate different categories of expenses. You can also add doodles or stickers to add some personality to your spread.

Creative Add-Ons

There are many creative add-ons you can use to make your budget spread more functional. For example, you can create a “debt snowball” tracker to help you pay off credit card debt or student loan debt. You can also create a savings jar tracker to help you reach your savings goals.

Printables and Templates

If you’re not confident in your drawing or lettering skills, there are many printables and templates available online that you can use to create your budget spread. Some of these resources are free, while others require a small fee.

The best budget bullet journal spread is one that works for you. Whether you prefer a quarterly or yearly spread, prefer quotes or pizza doodles, or want to use a bullet journal app or a physical journal, there are many options available to help you create the best budget spread for your needs.

Tracking and Analyzing Financial Progress

Tracking and analyzing financial progress is an important aspect of budgeting. Bullet journal spreads can serve as a useful tool for tracking and analyzing financial progress. Here are some subsections to consider:

Monthly and Quarterly Reviews

Monthly and quarterly reviews are important to track progress towards financial goals. By reviewing spending tracker and finance spreads, individuals can determine where they are spending money and where they can cut back. This information can be used to adjust the budget and set new financial goals. Bi-weekly or monthly bullet journal expense trackers can help individuals stay on track.

Financial Goal Milestones

Bullet journal budget spreads can be used to track financial goal milestones. This can include tracking savings goals, credit score, and debt repayment progress. By tracking these milestones, individuals can see how far they have come and how much further they need to go to reach their financial goals. Handwriting financial milestones in a bullet journal can also help individuals stay motivated.

Adjusting Your Budget

Adjusting the budget is a necessary step in tracking and analyzing financial progress. Bullet journal savings trackers can help individuals see where they can cut back and how much they can save. By adjusting the budget, individuals can ensure they are on track to meet their financial goals. It is important to adjust the budget as needed to ensure financial success.

Bullet journal spreads can be a useful tool for tracking and analyzing financial progress. By using bullet journal budget spreads, individuals can track spending, set financial goals, and adjust the budget as needed.

Frequently Asked Questions

How can I set up a monthly budget tracker in my bullet journal?

To set up a monthly budget tracker in your bullet journal, you can create a simple table to track your income, expenses, and savings. You can also use different colors and symbols to categorize your spending and make it easier to visualize your budget. Another option is to use pre-designed templates or spreads that are available online or in bullet journaling books.

What are some creative ideas for budget notebook spreads?

There are many creative ideas for budget notebook spreads, such as using a monthly expense tracker, a debt payoff tracker, a savings tracker, or a bill tracker. You can also use different themes and colors to make your spreads more visually appealing, or add motivational quotes or stickers to keep yourself motivated.

Where can I find free printable templates for budget bullet journal spreads?

There are many websites and blogs that offer free printable templates for budget bullet journal spreads, such as Pinterest, Etsy, and Bullet Journal Joy. You can also find templates in bullet journaling books or create your own custom spreads using online tools or software.

What are the best practices for maintaining a spending tracker in a bullet journal?

The best practices for maintaining a spending tracker in a bullet journal include setting realistic goals, tracking your expenses regularly, reviewing your budget periodically, and adjusting your spending habits as needed. You should also make sure to keep your journal organized and up-to-date, and avoid overspending or impulse purchases.

Can you recommend any bullet journal budget spreads for beginners?

For beginners, simple spreads like a monthly expense tracker or a savings tracker can be a good place to start. You can also use pre-designed templates or spreads that are easy to follow and customize, or join online communities or forums to get inspiration and advice from other bullet journal enthusiasts.

What are the essential elements to include in a bullet journal budget planner?

The essential elements to include in a bullet journal budget planner are your income, expenses, savings, and debt. You should also include categories for different types of expenses, such as rent, utilities, groceries, entertainment, and transportation. You can add notes or reflections on your spending habits, goals, and progress.